fetching latest news

News tagged in:

Baker Hughes, an energy technology company, has been awarded a major contract by Eni and its partner Petroci for the Baleine Phase 2 project in Ivory Coast, Africa’s first Scope 1 and 2 net-zero emissions development.

The African Energy Chamber (AEC), serving as the voice of the African energy sector, has officially launched its South Africa-focused market report, providing a comprehensive overview of the state of play of the country’s energy sector.

Chariot Limited has completed the Front-End Engineering and Design (“FEED”) on the key components of its flagship Anchois gas development project offshore Morocco. The Anchois gas field is located within the Lixus Offshore license area, in which Chariot holds a 75% interest and operatorship, alongside ONHYM which holds a 25% interest.

China's finance and investment spending in Belt and Road countries fell slightly in the first half compared to a year earlier, with no new coal projects and investments in Russia, Egypt and Sri Lanka falling to zero, new research showed. Saudi Arabia was the biggest recipient of Chinese investments over the period, with about $5.5 billion, According to the Shanghai-based Green Finance and Development Center (GFDC) in research published on Sunday.

Africa must act quickly to profit from its vast reserves of natural gas that the world will only want until it can shift towards lower carbon technology, the International Energy Agency said on Monday. In its Africa Energy outlook for 2022 published on Monday, the IEA Africa could be in a position by the end of the decade to export some 30 billion cubic metres (bcm) to Europe, which is currently hungry for gas because it is trying to reduce its reliance on Russia.

Foreign Minister Luigi Di Maio and Ecology Transition Minister Roberto Cingolani will visit Angola on Wednesday and Congo on Thursday to line up liquefied natural gas (LNG) deals.

The acquisition, announced yesterday, came at a time most International Oil Companies (IOCs) in Nigeria were divesting, retaining mainly their operations in the deep waters.

The African Petroleum Producers Organisation (APPO) has said the Dangote oil refinery will cut the importation of petroleum productions in Africa by 36 per cent. APPO also said the success of the project could incentivise the rise of similar projects across Africa despite the current focus on energy transition. The Secretary-General of APPO, Dr Omar Farouk Ibrahim, said the refinery will supply over 12% of Africa’s products demand when it becomes operational. “Currently, Africa’s daily petroleum demand is 4.3 million barrels per day (mbpd). Of this volume, 57% is produced locally (on the continent) while 43% is imported. “When Dangote Refinery is fully on stream, the percentage of Africa’s products import shall drop to 36%. This is even as the total volume of products demand rises to 5.4mbd. You can therefore see the huge impact that Dangote refinery shall be making to overall products supply in Africa. Dangote shall be supplying over 12% of Africa’s products demand.

Investing.com – Oil was up Tuesday morning in Asia, after rebounding almost 5% the day before. Concerns about the omicron COVID-19 variant’s impact on fuel demand receded, while talks to revive an Iranian nuclear deal hit a snag. Brent oil futures were up 0.36% to $73.34 by 10:22 PM ET (3:22 AM GMT) and WTI futures gained 0.63% to $69.93. Ntsakisi Maluleke, a public health specialist in South Africa’s Gauteng province said over the weekend that patients with the new omicron COVID-19 variant had only shown mild symptoms. National Institute of Allergy and Infectious Diseases director Anthony Fauci also said, "it does not look like there's a great degree of severity" so far.

The suspects were arrested by the Nigerian Navy and handed over to officials of civil defence. The Nigerian Navy Forward Operating Base (FOB) in Ibaka, Mbo Local Government Area of Akwa Ibom State, said it has arrested 35 suspected vandals of petroleum pipelines. The Commanding Officer, FOB, Mohammed Abu, told reporters in Ibaka on Wednesday that the base also impounded 408 drums of illegally refined Automotive Gas Oil (AGO) from the suspects. Mr Abu, Navy Captain, spoke when he handed over the suspects and exhibits to an official of the Nigeria Security and Civil Defence Corps (NSCDC).

LAGOS, Nigeria — The staff at Big Cabal, a media start-up, wanted to ditch its diesel generator, but needed something to keep the office air-conditioners running. The generator was noisy, expensive and, maybe worst of all, bad for the environment. Hoping for a greener solution to its problem, Big Cabal in 2019 bought solar panels for its two-story office building.

African Energy Week (AEW) 2021 in Cape Town is committed to providing a real conversation on the issues facing African people and African businesses, offering attainable solutions through which the oil and gas industry can help drive. With global stakeholders pledging net-zero emissions by 2050, and the move to renewable energy holding significant financial challenges for African countries, the role of the oil and gas industry has been brought to light, with the idea of an African carbon market both deliberated and debated among key industry leaders and global stakeholders. With a panel discussion taking place at the Ninth Conference on Climate Change and Development in Africa (CCDA-IX) under the theme, ‘Can carbon markets work for Africa?’ key insights were provided into whether or not a carbon market could work in Africa, with speakers introducing current national strategies to address carbon emissions.

Despite important changes over the past decade, efforts to expand and modernize the sector need to be redoubled. Indeed, current electrification rates, generation-capacity levels, and security-of-supply indicators underscore that much is yet to be accomplished. New research, co-authored at the UC Berkeley Goldman School of Public Policy, identifies five sets of complementary actions to put Africa’s electricity sector on track to sharply increase electrification rates and secure long-term access to affordable and cleaner energy. The research — “An action agenda for Africa's electricity sector” — was published today (Aug. 5, 2021) in the journal Science. "Investment in, and integration of, clean energy across Africa can enable the full suite of the UN’s Sustainable Development Goals (SDG) and make the energy future of the continent one that enables equity and climate justice,”

Following President Biden's Interim National Security Strategic Guidance signaling for continued growth in partnerships with African economies, the African Energy Chamber (AEC) believes it is vital to engage U.S. companies and investors to counter the often-wrong preconceptions about investing in the continent, as Africa has some of the fastest-growing economies globally and possesses significant investment and development opportunities for U.S. firms. Majors like Chevron, ExxonMobil, and Kosmos Energy making significant discoveries and operating in multiple countries like Angola, Mozambique, Nigeria, Equatorial Guinea, Senegal, Ghana, and others.

The decline of Angola, from being Africa’s top crude producer five years ago to barely pumping more than war-torn Libya today, shows the heavy toll of a slump in oil-industry investment. The nation’s production has fallen by more than a third since 2015. Despite government efforts to stimulate activity, just a handful of drilling rigs now work in the deep Atlantic waters that hold the country’s greatest resources.

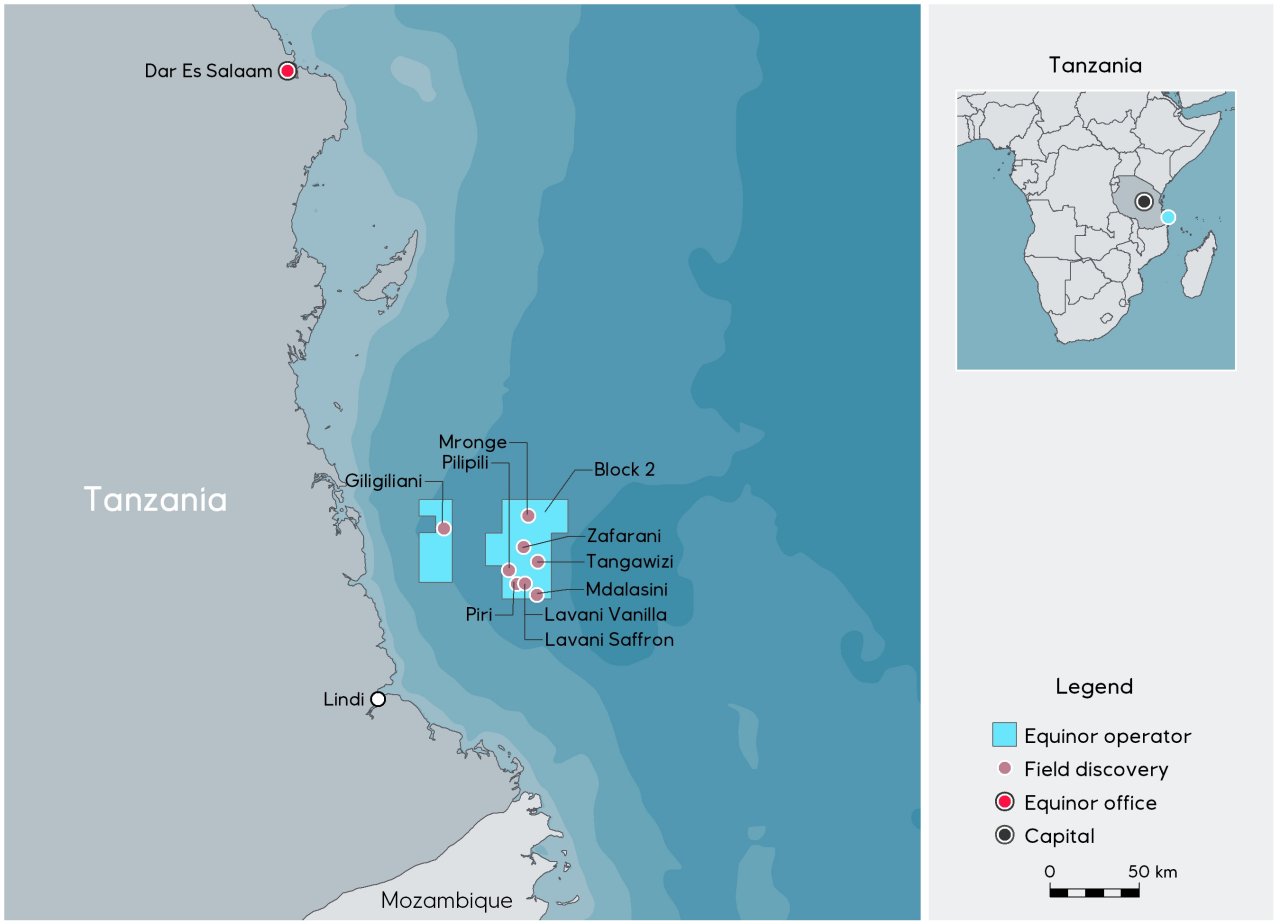

Equinor has decided to write down book value of its Tanzania LNG project (TLNG) on company’s balance sheet by 982million USD. Equinor is operator with 65% participating interest, along with ExxonMobil’s working interest of 35%. TPDC has the right to participate with 10% interest. Equinor made nine gas discoveries in Block2 offshore Tanzania with estimated volumes of 20Tcf of GIP.

Africa's largest lender by assets, Standard Bank, has been criticised for its lending policies. The recent climate exposure report that it published reveals that it has $4 billion in loans and commitments to the coal, oil and gas sectors on its books. The bank is being called out as 4% of all its lending is to fossil fuel industries. The renewables share only 0.8% of the same.

Following Mexico's refusal, OPEC+ on Easter Sunday agreed upon 9.7mn bpd of production cut. “These production adjustments are historic. They are largest in volume and the longest in duration, as they are planned to last for two years", said OPEC's Secretary-General. This decision has brought hope for the African oil producers giving them a financial boost. NJ Ayuk welcomed the decision declaring it a home run by OPEC.