fetching latest news

News tagged in:

WASHINGTON – The American Petroleum Institute (API) published an important first-edition document focused on improving the safety of onshore drilling and production operations. API Bulletin 16H, Automated Safety Instrumented Systems for Onshore Blowout Preventer Actuation,

This week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 3.670 million barrels. U.S. crude inventories have shed some 65 million barrels since the beginning of the year. Analyst expectations for the week were for a smaller draw of 2.633 million barrels for the week. In the previous week, the API reported a draw in oil inventories of 815,000 barrels, compared to the 2.60-million-barrel draw that analysts had predicted. At the start of the day at 7:30 a.m. EST WTI had risen by more than 1% to $69.73, but was still $1 per barrel week on week. Brent was also trading up by more than 1% at $72.56—also $1 under last week's levels. Oil prices were trading up by more than 3% on Tuesday in the run-up to the data release, after a brutal Monday that saw prices dip as much as 5% on fresh Omicron fears.

Crude oil prices recovered somewhat on Wednesday morning after the Energy Information Administration reported an inventory draw of 4.6 million barrels for the week to December 10. At 428.3 million barrels, crude oil inventories remain 7% below the five-year average. Last week’s draw compares with a modest 200,000-barrel decline in crude oil inventories for the previous week. On Tuesday, the American Petroleum Institute estimated a crude oil inventory draw of 815,000 barrels for the week to December 10. In fuels, the agency reported draws.

The American Petroleum Institute (API) reported a small inventory build in crude oil that was just enough to keep the market from panicking over dwindling inventories. This week, the API estimated the inventory build for crude oil to be 655,000 barrels. U.S. crude inventories are now 60 million barrels below where they were at the beginning of the year. Analyst expectations for the week were for a build of 1.550-million barrels for the week. In the previous week, the API reported a draw in oil inventories of 2.485-million barrels, compared to the 1.90-million-barrel build that analysts had predicted.

Oil prices dropped in the international market on Wednesday, stressed by rising U.S. inventories and the rift within OPEC intensified oversupply concerns. Brent futures slipped 3.6%, at $25.41 a barrel. U.S. West Texas Intermediate (WTI) crude futures dropped to $20.37 a barrel. Data released by the American Petroleum Institute showed a rise of 10.5 million barrels in U.S. crude inventories.

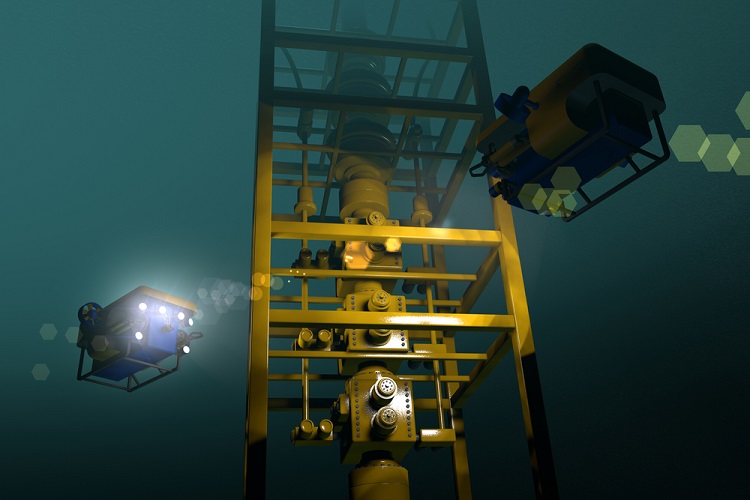

Trade association, the American Petroleum Institute (API) has granted a contract for the full-scale S-N fatigue testing of large diameter bolts to Norway-based DNV GL. The program aims at improving fatigue assessments of critical bolted connections, specifically in subsea applications. DNV GL will carry out the testing at its global laboratory network. The new test data will be shared on Veracity, DNV GL’s digital platform.

The latest monthly statistical report coming from American Petroleum Institute (API) showed record 4.4 MMbpd productions of natural gas liquids (NGL) in US, last month. US also leveled the previously set record for crude oil production at 10.7 MMbpd. Solid economic activities in July drove the demand for US petroleum to 20.6 MMbpd, which is its highest level in 11 years.

Leading engineered polymer solutions firm, Trelleborg has launched a new custom-made wellhead sealing solution. In the new metal end cap seal, the flexibility of an elastomer has been combined with the pressure and extrusion resistance of a metal-to-metal bonded component. In static applications, the seal can sustain pressures up to 15,000 psi. The sealing materials are in total compliance with Total, NORSOK, NACE, and API standards.

Oil prices, today, went down again after the industrial body API reported a rise in US crude inventories last week, disregarding analyst speculations of a significant reduction. Brent futures were down by 0.4% and traded at $71.85 a barrel. West Texas Intermediate (WTI) crude was down by 0.5%, priced at $67.72. The US Department of Energy Information Administration will today release official numbers in this regard.

The American Petroleum Institute (API) has shown disappointment from US administration denial to exclude imported steel to be used in certain parts of oil and gas industry, from Section 232 tariffs. API VP believes that the process which decided whether to grant exclusion or not lacks transparency. The association has said that the decision is misguided and will impact American energy production and jobs.

US petroleum demand is approaching its highest level in eleven years. The macroeconomic background is in sync with the rising demand and continues to reflect solid momentum in 2018 so far. Economists at the American Petroleum Institute (API) say that consumers will gain from this momentum and would enjoy affordable and reliable fuels produced in their own country. Moreover, a buoyant industry value chain has absorbed the growth efficiently.

As reported by Reuters, Brent crude prices slipped back consecutively for a second day owing to weak economic figures from China and growing U.S. oil inventories. Traders across the globe expressed their concern regarding an international economic slowdown as China reported that factory growth has sunk to its lowest rate since 2016.