fetching latest news

News tagged in:

Seatrium Limited, through its wholly-owned subsidiary Sembcorp Marine Offshore Platforms Pte. Ltd. (“SMOP”), has secured a contract worth more than S$500 million for two offshore wind farm substations from Empire Offshore Wind LLC, a joint venture between Equinor and bp.

BP Plc’s Chief U.S. Economist Michael Cohen said the oil industry focused too much on cutting greenhouse gases last year, eroding its ability to keep pace with demand.

The UK’s two biggest listed oil companies will face an odd dilemma this week as they present what is likely to be their best set of results for years while facing calls to cough up more in tax.

The Russian oil and gas giants listed on the London Stock Exchange have seen their shares crashing after Putin invaded Ukraine last week. Since last Thursday, when Russia invaded Ukraine, shares in Rosneft, Gazprom, Lukoil, and Surgutneftegas collapsed on the London market,

Norwegian energy giant Equinor said it will start the process of exiting the company’s joint-ventures in Russia, amid the Ukraine invasion. The company said in a statement on Monday that in addition to exiting its operations in Russia, it “has decided to stop new investments" into the country.

Mantashe said the pausing of operations in SA’s biggest refinery, SAPREF, will cause job losses and uncertainty of supply. Mineral Resources and Energy Minister, Gwede Mantashe has called Shell and Beyond Petroleum (BP) greedy and arrogant for pausing refinery operations at SAPREF, their Durban-based facility.

BP's underlying replacement cost profit, the company's definition of net earnings, reached $4.1 billion in the fourth quarter of 2021, exceeding analysts' expectations for a $3.93 billion profit.

Risks for BP and Shell's substantial operations in Russia intensified following the announcement by the UK of legislative changes as part of moves to bolster sanctions against Moscow. The amendments that are to be approved by the UK Parliament by Feb. 10 expand its sanctions targets from those directly linked to Russian actions in Ukraine,

The House Oversight Committee on Thursday expanded its investigation into the fossil fuel industry’s involvement in spreading disinformation about the role fossil fuels play in causing climate change. Committee Chairwoman Carolyn Maloney, D-N.Y., and Subcommittee on the Environment Chairman Ro Khanna, D-Calif., called on top executives at ExxonMobil, BP, Chevron, Shell and lobbying groups American Petroleum Institute and the U.S. Chamber of Commerce to testify before Congress next month. Oil and gas companies have faced a slew of lawsuits from cities and states across the U.S. over their investments in campaigns to undermine climate policy and downplay the impact of burning fossil fuels on global warming. The probe also comes as Democrats look to pass major climate and clean energy policy in the budget reconciliation bill, efforts that have faced opposition from some fossil fuel companies.

BP reached an agreement today to purchase 9GW of solar development projects in the US from independent US solar developer 7X Energy for $220 million. The acquisition is a step towards BP’s target of growing its net developed renewable generating capacity to 20GW by 2025 and aim to increase this to 50GW by 2030.The deal will also grow BP’s renewables pipeline from 14GW to 23GW.

BP has started a recruitment campaign for the people who will drive its expanding clean energy ambitions. The London-based oil and gas company is looking to fill 100 offshore-wind jobs in the UK and the U.S., a figure which could double by the end of the year. The recruitment drive comes even as thousands of other employees have left the company amid a wider restructuring.

BP Plc and Eni SpA are considering merging their Angolan oil, gas, and liquefied natural gas assets into a joint venture in a bid to revive output following years of decline. The companies’ Angolan assets together produce more than 200,000 barrels of oil equivalent a day, BP and Eni said in a statement on Wednesday. Merging them would bring “significant opportunities” to “boost future developments” and increase investment in the basin, they said.

Petrofac secured a contract with bp to develop operational procedures for their Greater Tortue Ahmeyim (GTA) Project in Mauritania and Senegal. Centered on minimizing risk and harm to personnel, plant, and the environment, the procedures will encompass all offshore operations, including subsea, floating production storage and offloading (FPSO), and hub.

OGUK today announced the details of its Annual Conference. The three-day virtual conference entitled ‘Industry in Transition: Driving A Net Zero Energy Future' will take place online between June 1-3, 2021. BP CEO Bernard Looney will speak on day one of the conference, with OGUK Chief Executive Deirdre Michie expected to restate the UK sector's commitment to supporting jobs now and through a green recovery.

Renewable energy will account for a far larger share of global supply in 2050 than major oil companies or the International Energy Agency (IEA) expect, Oslo-based consultancy Rystad Energy said on Thursday. Its updated models show renewables meeting 74 per cent of total energy demand by 2050, compared to 43 per cent, 45 per cent and 69 per cent in the most aggressive scenarios from energy firms Equinor, Shell and BP.

New Delhi: Reliance Industries Ltd and its partner BP Plc of UK have sought bids for sale of 5.5 million standard cubic meters per day of additional natural gas that will be available for sale from their eastern offshore KG-D6 block. The e-auction is slated for April 23 and the gas supply will start from late April or early May, according to the tender document.

BP eked out modest profit, but was just fraction of typical pre-pandemic levels. Cash flow, which failed to cover dividends and capital expenditure despite deep cuts to both, raised questions about company’s ability to sustain investor returns. Shares fell 4%. BP’s fourth-quarter net income was $115million, down from $2.57billion year earlier. Company fell short of average analyst estimate of $440million.

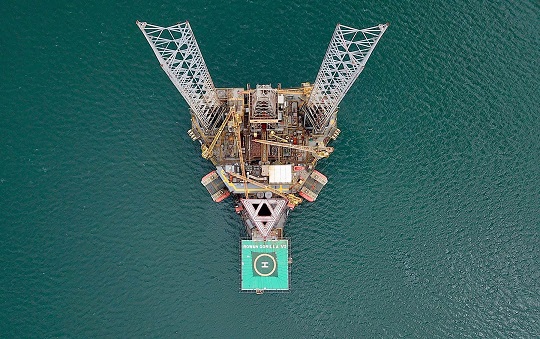

Neptune Energy and its joint venture partners bp and JAPEX, announced drilling has commenced on Seagull project in the UK Central North Sea. The Gorilla VI (JU-248) jack-up rig, operated by Valaris, will drill four wells for development over the course of drilling campaign which is expected to last 18 months. Seagull is expected to produce 50,000 boe/day (gross).