fetching latest news

News tagged in:

PetroChina may sell out from natural gas projects in Australia and oil sands in Canada to stem losses and divert funds to more lucrative sites in the Middle East, Africa and central Asia, two people with knowledge of the matter said. PetroChina's plan follows a similar strategic shift by smaller state peer CNOOC Ltd (0883.HK), which was preparing to exit its operations in Britain, Canada and the United States because of concerns the assets could become subject to Western sanctions.

PetroChina may sell out from natural gas projects in Australia and oil sands in Canada to stem losses and divert funds to more lucrative sites in the Middle East, Africa and central Asia, two people with knowledge of the matter said. PetroChina's plan follows a similar strategic shift by smaller state peer CNOOC Ltd (0883.HK), which was preparing to exit its operations in Britain, Canada and the United States because of concerns the assets could become subject to Western sanctions.

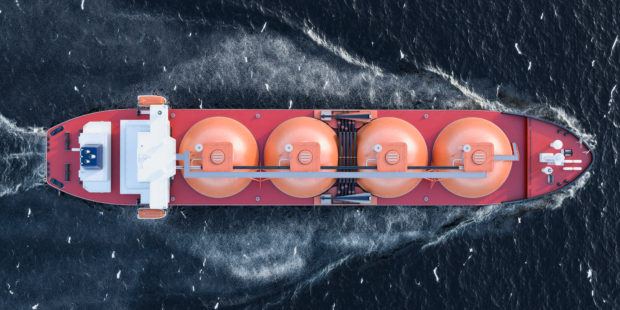

US-based Venture Global LNG has signed a pair of liquefied natural gas (LNG) supply deals with China National Offshore Oil Corporation (CNOOC). Significantly, the move underscores China’s increasing appetite for US LNG and it marks the first LNG supply agreement signed by a US exporter with CNOOC, China's largest importer of LNG.

China National Offshore Oil Corp, or CNOOC, will buy two cargoes of LNG with offset carbon emissions from Royal Dutch Shell, thus marking China's first gas imports of this kind. The companies will use carbon credits won in projects in China's northwest Xinjiang and Qinghai region to offset the carbon emissions involved in producing and consuming the two gas cargoes. The two cargoes will be auctioned at the Shanghai exchange.

China National Offshore Oil Corporation (CNOOC), the largest offshore oil and gas producer in China, and Royal Dutch Shell, the world's leading energy and petrochemical conglomerate, signed a strategic cooperation framework agreement worth 5.6 billion U.S. dollars on Sunday. The new cooperation, based on the CNOOC and Shell Petrochemical Company Limited, is the CNOOC and Shell Huizhou phase III ethylene project.

Operational Excellence (Opex) Group has backed a multimillion pound contract with Cnooc. It is a three-year deal for Cnooc International's North Sea assets. Opex will roll out its predictive analysis technology at the Buzzard, Golden Eagle and Scott platforms. Also, ts X-pas service will use data science to monitor all the installations. "We are pleased to have extended our scope across the company’s UKCS assets", said Chief Executive of Opex.

State-run Abu Dhabi National Oil Corporation (ADNOC) has entered into an agreement with Chinese oil major, CNOOC to collaborate in the upstream and downstream sectors and LNG. The agreement requires the firms to share knowledge, best strategies and technologies in ultra-sour gas development. ADNOC and CNOOC will also consider business opportunities in the downstream sector. Adnoc Group CEO and CNOOC chairman exchanged the Strategic Framework Agreement.

CNOOC China Limited has signed a Cooperation Framework Agreement with Sinopec. Three joint study agreements have been signed between both the companies, “Joint Study Agreement on Bohai basin,” “Joint Study Agreement on North Jiangsu basin and South Yellow Sea basin” and “Joint Study Agreement on Beibu Gulf basin.” This cooperation will help to scientifically optimize the potential exploration zones and targets.

Chinese E&P giant, CNOOC has awarded a contract extension to Maersk Drilling for the Maersk Innovator to perform drilling activities at the Buzzard field. An ultra-harsh environment jack-up rig, the Maersk Innovator will continue to drill infill wells in the North Sea until February 2020. Hydrocarbons were discovered in the Buzzard field back in 2001. CNOOC expects first oil from Phase 2 in 2021.

Chinese oil major, CNOOC has entered into a Heads of Agreement (HoA) with Russian gas producer, Novatek for 10% interest in the Arctic LNG 2 project. The Arctic LNG 2 Project is one of the largest onshore conventional natural gas projects, operated by JSC Novatek. The project involves the development and production of Utrenneye gas field, apart from the construction and operation of three LNG trains.

CNOOC has signed a production sharing contract (PSC) with Smart Oil, informed CNOOC Limited. The contract is for the Bohai 09/17 Block which covers 509.3 square kilometers. Under the scope of this agreement, Smart Oil will be the operator of the field during the exploration period. And when the development phase starts, CNOOC will have 51% of the participating interest in any commercial discoveries of the Bohai 09/17 Block.

According to the sources, China National Oil Corp (CNOOC) has sold a LNG cargo which is floating offshore South Korea. This cargo has been sold for the second time pointing out the drop in winter gas demand in China. Unlike 2017/18 winter, when China was desperate to keep up with the super-chilled fuel demand, this move signifies that the nation has overcome those times.

China’s CNOOC has received its first LNG cargo from the Russian Arctic gas project on November 11. The cargo was shipped from Yamal and was bought from Novatek, a Russian firm. Novatek also controls Yamal LNG along with Total, CNPC and the Silk Road Fund. Meanwhile, CNPC is also planning to buy at least 3 million tonnes of LNG from Yamal starting from 2019.

Aker Solutions has signed a huge subsea deal with CNOOC. Under this deal, which is worth more than £158 million, Aker will supply umbilicals and subsea production system for the Lingshui 17-2 gas field. This project is located almost 5000 feet deep and is CNOOC’s first project at this depth. The work scope includes connecting the subsea development to a new, semisubmersible platform and more than 930 miles of umbilicals.

French supermajor, Total and Chinese state-owned CNOOC have modified the sale and purchase agreement for LNG supply, inked in 2008. While the contract volume has been increased from 1 Mtpa to 1.5 Mtpa of LNG, the term of the contract has been extended from 15 years to 20 years. The move will further strengthen the cooperation between the firms in the liquefied natural gas business.

As previously announced, auction for the four blocks in Rio de Janeiro in the Santos in Campos basins will be held just a week before the presidential elections, on Friday. The companies registered for this are CNOOC, Chevron Corp, Equinor, BP and Total. These companies will have the last chance to try for one of the most wanted Brazil’s offshore oil. There is a fear regarding obstacles for foreign investment.

Chinese state-owned CNOOC successfully deployed Clariant’s MegaMax 800 methanol synthesis catalyst at its China BlueChemical methanol plant. The 800 kilotons facility runs on DAVY™ methanol process technology to manufacture methanol-based chemical products and mineral fertilizers. MegaMax 800 results in 40% higher productivity than previous catalyst generations and can sustain its performance advantage at low-temperature conditions as well.

China’s energy giant, CNOOC Limited has informed that production has begun at the Penglai 19-3 oilfield 1/3/8/9. CNOOC is the operator in this project, holding 51% interest in the oilfield, rest 49% are being held by ConocoPhillips. This comprehensive adjustment project is located in Bohai Sea and has the advantage of existing facilities at Penglai 19-3 oilfield. The water depth of the oilfield is 27 to 33 m.