fetching latest news

News tagged in:

Suncor Energy could drill up to 16 exploration and appraisal wells in prospective block in Newfoundland & Labrador

China’s President Xi Jinping called for greater efforts to curb carbon dioxide emissions, a signal the biggest polluter won’t backslide on climate targets even as it turns to fossil fuels for energy security.

The Head of Geopolitics at Energy Aspects, Richard Bronze, has told Rigzone that he doesn’t see any realistic prospect of the 2015 Iran nuclear deal (the Joint Comprehensive Plan of Action) being restored after the failed negotiations over 2021-22.

Eni delivered a gas cargo of 90 MMcm to the SNAM regasification terminal in Piombino, Italy, on July 8. Unloading operations took place following the completion of the test phase and mark the beginning of the terminal’s commercial operation.

Valeura Energy shuts in 2400 barrels per day of oil at Wassana after floating storage and offloading vessel hits Calm buoy

ASCO, a global integrated logistics and materials management company, has appointed Tony Wright as its new Group Chief Financial Officer (CFO) following the retirement of Gary Paver.

An offshore drilling platform stands in shallow waters at the Manifa offshore oilfield, operated by Saudi Aramco, in Manifa, Saudi Arabia, on Wednesday, Oct. 3, 2018.

Singapore-headquartered upstream independent Jadestone Energy intends to strengthen its executive management team following the past several months that its chairman Dennis McShane admits have been “disappointing” to all its stakeholders.

The North Sea’s massive potential contribution to energy security, net zero, jobs and investment topped the agenda at an industry and government summit in Aberdeen on June 27.

Louisiana’s Vermilion Parish will be home to a landmark CO2 transportation and storage project ExxonMobil is building to help the state’s industries reduce their emissions.

On June 8, a Rebellion Energy Solutions methane-abatement and land-restoration project became the first orphan oil-and-gas well plugging project to be listed by the American Carbon Registry. Rebellion's project, for which it completed operations last month, is designed to generate durable, verifiable carbon-offset credits under ACR's recently finalized methodology.

Baker Hughes, an energy technology company, has been awarded a major contract by Eni and its partner Petroci for the Baleine Phase 2 project in Ivory Coast, Africa’s first Scope 1 and 2 net-zero emissions development.

Global oil demand growth will trickle nearly to a halt by 2028, the International Energy Agency found in its latest Oil 2023 medium-term market report.

New Shell chief Wael Sawan has shown his hand at the supermajor with a long-anticipated strategy shift confirmed today.

Government and companies must co-operate to ensure more workers do not fall victim to oil and gas tax schemes that go awry

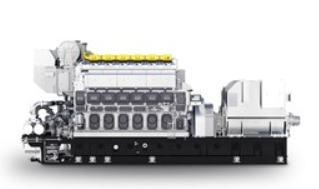

MAN Energy Solutions has introduced its latest engine, an auxiliary MAN 35/44DF CD type. Developed in cooperation with STX Engine and solely for production by MAN licensees, the new engine is particularly aimed at container and LNG carrier applications.

The Inflation Reduction Act, as well as local, state, lender and utility incentives have made residential solar energy systems more attractive improvement projects for homeowners.

Australia’s vast liquefied natural gas (LNG) industry is trying to pull off something that seems almost impossible. They want to lead the transition to clean and renewable energy, while at the same time continuing to invest in, and produce fossil fuels.