fetching latest news

News tagged in:

Oil rose on Monday as supply concerns driven by lower OPEC output, unrest in Libya, and sanctions against Russia outweighed fears of a demand-sapping global recession. Eurozone inflation hit yet another record high in June, strengthening the case for rapid European Central Bank rate increases, while U.S. consumer sentiment hit a record low. Brent crude rose $2.26, or 2%, to $113.89 a barrel by 12:47 p.m. ET (1648 GMT) after falling more than $1 in early trade. U.S. West Texas Intermediate (WTI) crude rose $2.20, or 2%, to $110.63, in thin volume during the U.S. Independence Day holiday.

Brent crude futures rose 21 cents, or 0.2%, to $113.37 a barrel at 0020 GMT, while U.S. West Texes Intermediate (WTI) crude futures slipped 2 cents to $109.19 a barrel.

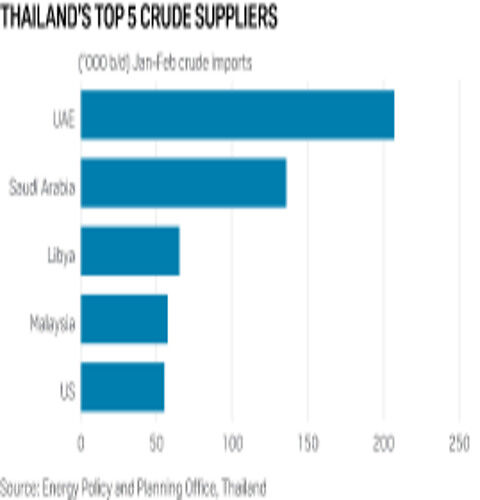

Libya's oil production woes may not dramatically alter Asia's crude buying plans due to the region's relatively low dependence on those supplies, but refiners are bracing for some price impact and supply squeeze as traditional customers of the North African OPEC producer scramble for cargoes from elsewhere.

SINGAPORE :Oil prices edged up on Monday as supply disruptions in Kazakhstan and Libya offset worries stemming from the rapid global rise in Omicron infections. Brent crude gained 16 cents, or 0.2per cent, at US$81.91 a barrel at 0406 GMT, while U.S. West Texas Intermediate (WTI) crude was up 15 cents, or 0.2per cent, at US$79.05 a barrel. Oil prices gained 5per cent last week after protests in Kazakhstan disrupted train lines and hit production at the country's top oilfield Tengiz, while a pipeline maintenance in Libya pushed production down to 729,000 barrels per day from a high of 1.3 million bpd last year.

Libya’s state oil company, National Oil Corporation (NOC), said in a statement on Friday, the maintenance work for the main crude transmission line at Al-Waha Oil Company was completed and that the oil output is back to around one million barrels per day (bpd). Contributed to reducing the losses resulting from the halt in production, which was estimated to reach about one million barrels, and the production of the Waha Company was raised by 200 thousand barrels per day.

The decline of Angola, from being Africa’s top crude producer five years ago to barely pumping more than war-torn Libya today, shows the heavy toll of a slump in oil-industry investment. The nation’s production has fallen by more than a third since 2015. Despite government efforts to stimulate activity, just a handful of drilling rigs now work in the deep Atlantic waters that hold the country’s greatest resources.

Libya is seeking funding from foreign oil companies to fix its ailing infrastructure after years of war and neglect, the nation's top energy official said. The state-owned National Oil Corp. was forced to shut down a leaking pipeline on Saturday, which cut the OPEC member's crude production by around 200,000 barrels a day.

Total SE is planning to increase energy investment in Libya. Libya’s state-run National Oil Corp. and Total had a virtual meeting and have decided to increase Libyan production capacity and output to the highest levels. Total and Libya's ties go back to decades. Former also holds shares in some key oil fields in Libya, including the nation’s biggest - The El Sharara and the offshore Al Jurf deposit.

Oil prices continued the journey downhill for the fourth straight day. The market is concerned with the resurgence of coronavirus and growing output from Libya. Brent decreased by 0.8%, to $42.30 a barrel. WTI fell by 0.6%. Commonwealth Bank has shown concerns saying “We don’t think oil markets are in a position to absorb the around 2% of global supply that OPEC+ are expected to restart from 1 January 2021”.

OPEC+ fears the second wave of COVID-19. The cartel is particularly troubled due to the jump in Libyan output. On Thursday, the Joint Technical Committee held a virtual meeting to discuss the issues. "In particular, a resurgence of COVID-19 cases across the world and prospects for partial lockdowns in the coming winter months could compound the risks to economic and oil demand recovery," said the panel.

With a significant drop in the new coronavirus cases in the epicentre of the outbreak, oil prices increased by 1% on Thursday. Brent went up by 0.8% and was traded at $59.57 a barrel. WTI rose by 0.9% and was traded at $53.78 per barrel. On the other hand, blockade of ports and oilfields in Libya and US sanctions on Rosneft has reignited the global oil supply worries.

Libyan state-run National Oil Corporation yesterday informed that the country's oil production fell by almost 80% ever since the Libyan National Army blocked its five key ports on January 18. The blockade has pushed the oil major to enact force majeure on exports from the terminals. NOC took to Twitter to inform that Libya's oil output tumbled to 284,153 b/d on January 24, from over 1.2 million b/d.

Oil prices dropped in the international market on Wednesday, as the Libyan crude shortage was seen offset by global fuel supply. Brent crude LCOc1 slipped by 0.2%, to $64.46 a barrel. US WTI crude futures CLc1 fell 0.3%, to $58.22 a barrel. “Market participants are already starting to fade this story – believing that this is a transitory outage,” said the commodity strategy head at RBC Capital Markets.

Oil prices slipped in the international market on Tuesday, as investors shrugged off the supply concerns over tensions in Libya. Brent crude LCOc1 dipped down 0.5%, to $64.90 per barrel. US WTI crude futures CLc1 were traded 0.2% lower, at $58.40 a barrel. Libya's state-run National Oil Corporation (NOC) is said to have declared force majeure on crude loadings from El Sharara and El Feel oilfields in Libya’s southwest.

Oil prices ramped up on Monday, pushed up by the shutting down of two Libyan crude production bases. Brent crude LCOc1 was priced 1.2% higher, at $65.60 a barrel. US WTI crude futures CLc1 were traded 1% higher, at $59.14 a barrel. Libya's state-run National Oil Corporation (NOC) yesterday informed about commencing shut down operations at two big oilfields after forces loyal to the Libyan National Army closed a pipeline.

Libyan state-run National Oil Corp. informed on Saturday about the shutdown of the country’s largest oilfield, El-Sharara due to suspected valve closure. NOC has launched an investigation on the matter. The El-Sharara oilfield, which pumps 290,000 bpd, has often been targeted by protesters or armed groups. NOC officials have revealed that the shutdown will cut Libya’s oil production to more than one million bpd.

Expectations from the OPEC-led supply cut and hopes of strengthening US-China ties sent the oil prices uphill today. International Brent crude futures climbed by 1.15%, and were priced at $60.89 a barrel. US WTI crude futures CLc1 rose by 1.2%, and were traded at $52.25 per barrel. Market traders said that disruptions to Libyan oil exports are also lifting the prices.

On Tuesday, oil prices climbed on the back of supply disruption in Libya’s El Sharara oilfield. The National Oil Company of Libya underwent losses the previous day and had to declare force majeure due to the seizure of El Sharara at the weekend by a local militia group. Brent was up by 0.6%, at $60.30 per barrel and WTI rose by 0.4%, at $51.19 per barrel.