fetching latest news

News tagged in:

European natural gas futures dropped to the lowest since the end of July as concerns eased over near-term exports from Russia that travel across Ukraine.

TotalEnergies and its partner SOCAR (State Oil Company of the Republic of Azerbaijan) announced the start of production of the first phase of development of the Absheron natural gas and condensate field in the Caspian Sea, around 100 km south-east of Baku.

The intensity of methane and greenhouse gas emissions from the oil and gas sector declined 28% and 30%, respectively, between 2019 and 2021 among the largest producers in the country, according to an analysis published by the nonprofits Clean Air Task Force and Ceres.

Australia’s vast liquefied natural gas (LNG) industry is trying to pull off something that seems almost impossible. They want to lead the transition to clean and renewable energy, while at the same time continuing to invest in, and produce fossil fuels.

Hong Kong received its first ever shipment of liquefied natural gas (LNG) amid a wider push to reduce reliance on coal.

Russia’s inability to purchase liquefaction modules (which enable natural gas to be converted into LNG) will hamper its ambitions, said S&P’s Director of South and Southeast Asia Gas, Zhi Xin Chong.

Delfin Midstream’s wholly owned subsidiary Delfin LNG LLC has finalized a binding Liquified Natural Gas (“LNG”) Sale and Purchase Agreement (“SPA”) with Hartree Partners Power & Gas Company (UK) Limited, a wholly owned subsidiary of Hartree Partners, LP.

Woodside Energy chief executive Meg O’Neill has slammed extremists who are doing the damnedest to scupper under development and new gas projects in Australia, the region’s largest liquefied natural gas exporter.

India's state-controlled Oil & Natural Gas Corporation (ONGC) has fired the starting gun on an integrated deep-water development project involving its Cluster 1 region on Block KG-DWN-98/2 in the prolific Krishna Godavari basin.

According to the International Energy Agency’s Gas Market Report, natural gas markets worldwide continued to tighten last year despite global consumption declining by an estimated 1.6% in 2022. Demand is forecast to remain flat in 2023, but the outlook is subject to a high level of uncertainty, particularly in terms of Russia’s future actions and the economic impacts of fluctuating energy prices.

Permian Strategic Partnership (PSP) President and CEO Tracee Bentley made a compelling case for the positive impact of oil and natural gas production on local communities during her testimony before the U.S. House Subcommittee on Energy and Mineral Resources at The University of Texas Permian Basin Midland Campus on Feb 13.

As Germany scrambles to avert a fuel crisis this winter, one rural district has become a role model for how the country might wean itself off dwindling imports of Russian gas - by producing all the energy that it consumes itself. The western district of Rhein-Hunsrueck uses a combination of solar, wind and biofuel to generate enough power to run its homes, public buildings and businesses, with enough left over to contribute to an electric car-sharing service and e-bikes. "Up until 1995, not a single kilowatt hour of energy used in our district was produced by us. Everything had to be imported," said Frank-Michael Uhle, the district's climate protection manager.

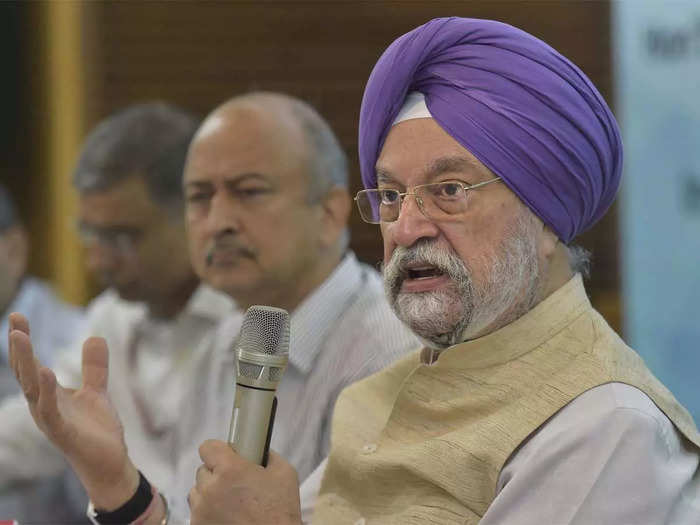

In a bid to boost the natural gas-based economy, Minister of Petroleum and Natural Gas & Housing and Urban Affairs Hardeep Singh Puri dedicated 166 Compressed Natural Gas (CNG) stations to serve the community. The 166 CNG pumps have been set up by GAIL (India) Limited and nine of its group City Gas Distribution (CGD) companies in 41 Geographical Areas (GAs) across 14 states. According to Puri, the CNG stations will incentivise the market of such vehicles and will have a positive impact on manufacturing and employment generation.

Africa must act quickly to profit from its vast reserves of natural gas that the world will only want until it can shift towards lower carbon technology, the International Energy Agency said on Monday. In its Africa Energy outlook for 2022 published on Monday, the IEA Africa could be in a position by the end of the decade to export some 30 billion cubic metres (bcm) to Europe, which is currently hungry for gas because it is trying to reduce its reliance on Russia.

Badri Mahapatra, promoter of the firm said, “The investment will be made next year for a pan-India presence in the CBG business.

Gop: A seismic survey campaign conducted by Oil India Ltd has yielded positive results with the discovery of oil and natural gas at two places of Gop block in Odisha’s Puri district

From April 1, the government has raised the price of gas for old fields of state-owned Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) to USD 6.1 per million British thermal unit for April-September 2022 from USD 2.9.

Germany's economy minister announced the seizure in a statement on Monday. The move came after the ministry of economic affairs learned that Gazprom Germania had been acquired by JSC Palmary and Gazprom export business services LLC