fetching latest news

News tagged in:

NEW YORK, Feb 3 (Reuters) - Oil prices surged in late-day trading Thursday, sending the U.S. crude benchmark through $90 a barrel for the first time since 2014 due to ongoing supply worries and as frigid weather cascades across the United States. Global benchmark Brent crude settled at $91.11 a barrel,

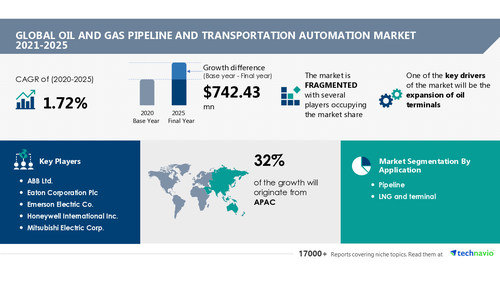

NEW YORK, Jan. 24, 2022 /PRNewswire/ -- The oil and gas pipeline and transportation automation market is set to grow by USD 742.43 million, progressing at a CAGR of 1.72% from 2020 to 2025. The report offers an up-to-date analysis regarding the current market scenario, the latest trends and drivers, and the overall market environment.

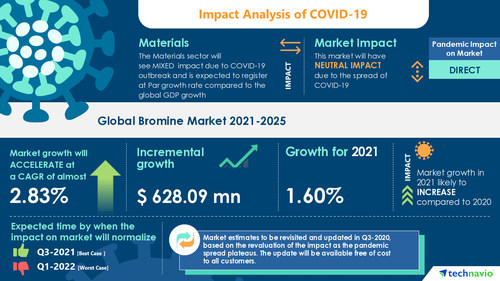

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Albemarle Corp., BEACON ORGANOSYS, Gulf Resources Inc., Honeywell International Inc., Israel Chemicals Ltd., LANXESS AG, Pacific Organics Pvt. Ltd., Perekop bromine, TETRA Technologies Inc., and Tosoh Corp. are some of the major market participants. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments. The growth of the oil and gas industry has been instrumental in driving the growth of the global bromine market. However, fluctuation in the prices of crude oil might hamper the market growth.

Greenbacker Renewable Energy Company LLC (“GREC” or “Greenbacker”), a leading owner and operator of sustainable infrastructure and energy efficiency projects, announced today that, through a wholly owned subsidiary, it purchased two utility-scale solar projects from Hecate Energy LLC (“Hecate”). The acquisitions of Hecate Energy Albany 1 LLC (“Albany 1”) and Hecate Energy Albany 2 LLC (“Albany 2”), both 20 MWac, showcase Greenbacker’s continued expansion into New York—a market where supportive policy and recent developments provide a compelling backdrop for renewable energy investment.

Oil advanced to the highest in over a month as a combination of declining U.S. petroleum product supplies and signs of stronger demand buttressed expectations for a revival in global consumption.Futures in New York jumped 1.5%, posting the largest back-to-back daily gains in two weeks. “There's a lot of green shoots in demand,” said Matt Sallee, portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets.

With the aim to pump up its private equity in the energy sector, Elliott Management Corp. has offered a proposal of $2 billion to acquire a portion of QEP Resources Inc. Elliott Management is New York’s investment firm who is ready to pay $8.75 a share in cash for the oil driller. QEP has given a conformation on receiving a proposal from Elliott.