fetching latest news

News tagged in:

North America cut another seven rigs week on week, according to Baker Hughes’ latest rotary rig count, which was posted on May 5.

Block Energy, an exploration and production company focused on Georgia, announces initial results from the WR-B01Za well, part of the initial development phase of the West Rustavi/Krtsanisi Field, the Company’s Project I. The well was drilled into the Middle Eocene reservoir, targeting lineations interpreted on the 3D seismic survey to represent productive sweet spots with high density of oil-bearing natural fractures.

Permian Strategic Partnership (PSP) President and CEO Tracee Bentley made a compelling case for the positive impact of oil and natural gas production on local communities during her testimony before the U.S. House Subcommittee on Energy and Mineral Resources at The University of Texas Permian Basin Midland Campus on Feb 13.

The next commodity supercycle could start and end with Chinese graphite, the single most important battery material right now in terms of supply and demand. And one of the world’s top producers is a North American company with processing facilities set up in China right next to one of the world’s largest graphite mines.

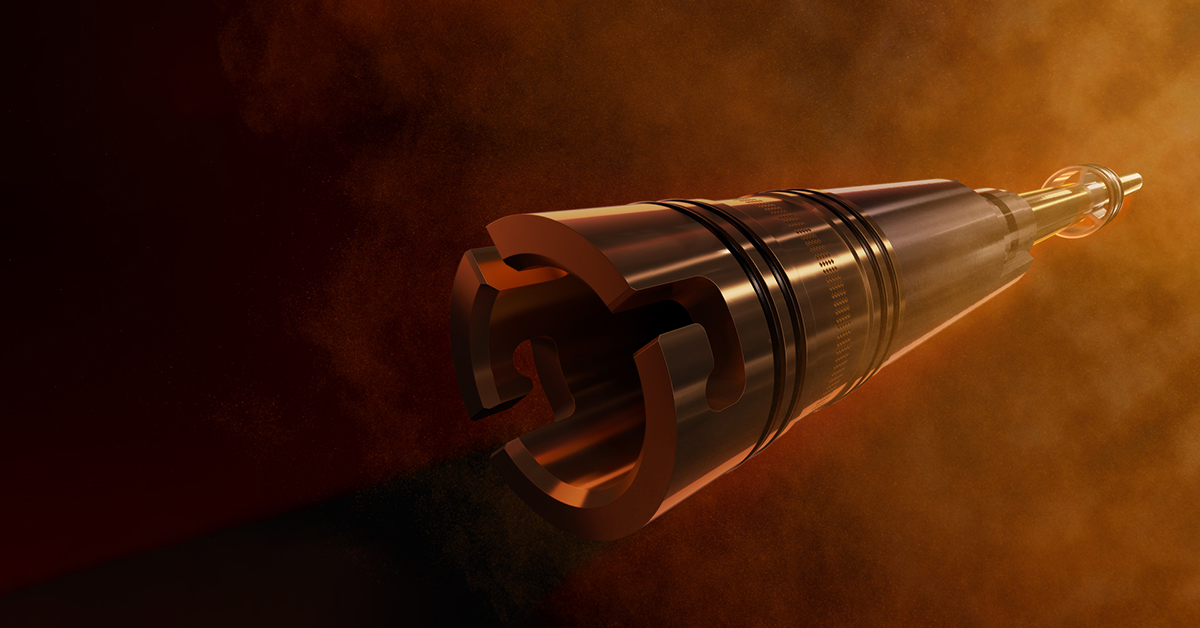

NOV, a leading manufacturer of directional drilling technologies, has launched its new Tolteq Hellfire measurement-while-drilling (MWD) configuration, which is specifically designed for harsh, vibration-prone, and high-temperature conditions in North America wellbores. The Hellfire MWD configuration includes real-time pressure-while-drilling (PWD) measurements, providing operators with access to advanced drilling optimization capabilities on every run. The modules are rated to 347°F (175°C) and 20,000 psi (1379 bar) to ensure performance in challenging applications.

China to get its largest hydrogen plant by the year 2022. The plant will be set by Air Products and Chemicals, Inc. world's largest hydrogen producer. The estimated capacity for the plant will be 30 tonnes of liquid hydrogen per day. The total investment for the plant is of $1 billion including other setups in the pipeline. It is an initiative by the Chinese government to steer the country towards “carbon neutrality” by 2060.

Acoustic Data has been contracted to deploy its SonicGauge Wireless Monitoring System in a gas field project in North-Africa. The technology will deliver real-time surface readout of downhole pressure and temperature on post-frac well tests via acoustic telemetry at the project which will enable live analysis. This will allow the subsurface teams to make fast and informed decisions regarding the field development, reducing standby time and the associated operating expenditure.

Aiming to improve the service capabilities and to keep up with the growing oil and gas market of North America, Henderson acquired HP Piping Solutions. It has taken over all the ongoing operations and all the assets of HP. HP piping Solutions has equipment for almost all the sectors of the industry, including high-pressure mud piping, mud gas separators, relief loops, and other drilling products.

Leading oilfield services company, Houston-based Schlumberger yesterday announced second quarterly earnings, reporting a profit for the company. Schlumberger CEO, Paal Kibsgaard regarded the second quarter as both busy and exciting. Schlumberger reported second-quarter revenue in North America to be around $2.5 billion, which is an increase of 12% sequentially. In the international markets of $4.4 billion, profits for the company grew by 6%.

Houston-based Fairfield Geotechnologies has formed a joint venture with Ikon Science to provide complete geoprediction services to the oil and gas industry in the North America. Fairfield recently rebranded itself from Fairfield Nodal, and the JV formation is in line of its growth strategy. The JV will utilize industry-leading geoprediction technology of Ikon Science, which includes RokDoc Ji-Fi inversion software, with Fairfield’s seismic acquisition, processing, and multi-client data library.

The quarterly profits of Schlumberger have surged by 88% as the increasing crude oil prices have encouraged the North American operators to step up drilling following which, the revenues were greatly maximized. The CEO has said that the firm is poised to deliver superior growth and financial returns by building on the broadest technology and expertise.

The first commercial LNG cargo ‘Adam LNG’ from Dominion Energy’s Cove Point terminal in Maryland on the east coast of USA has set sail. This would accelerate America’s emergence as an LNG powerhouse and it might challenge Australia and Qatar for global dominance in the next five years.

In order to enhance higher capacity natural gas applications, Emerson has expanded its size range of Fisher EZH and EZHSO pilot-operated regulators. These pressure reducing regulators are now available in new 6-inch, 8-inch and 12-inch dimensions and they allow for more flow. The new size offerings shall provide smooth and reliable operations.

The U.S. natural gas pipeline infrastructure is facing serious threats from cyber-attacks which raise prospects of tighter regulations. In the recent cyber-attacks, the electronic systems that were targeted help pipeline customers communicate their needs to the operators. The government realises the seriousness of the issue and is focusing on making web security a priority.

Saudi Aramco’s wholly-owned downstream oil and gas subsidiary, Motiva Enterprises, has signed MoUs up to $10 billion with the US companies Honeywell UOP and TechnicpFMC. The MoUs have been signed to support Motiva’s expansion into petrochemicals. Moreover, the announcements strengthen Aramco’s commitment to serve both the nations over the long term.

According to the BMO Capital Markets analysts, without mergers and acquisitions (M&A), the Canadian energy sector faces serious threats of extinction. Incentivizing change should be paramount. The process may take a number of years. Mergers and acquisitions act as the much needed catalyst and BMO Capital Markets now calls for consolidation.

Following the sinking of demand of LNG in Asia which is the prime buying region for the fuel, cargoes from nations have started arriving on British shores. Analysts are of the view that with shorter journey distance, Europe could turn into a promising destination.

China has announced that it will take steps against the measures introduced by the US President. China’s Ministry of Commerce said that it would levy 25% tariffs on imports of 106 U.S. products including automobiles and aircraft. There are emerging concerns regarding the declining economic growth and fuel demand. This decision has eliminated the previous support for prices and OPEC’s output plunged to the lowest in a year in March.