fetching latest news

News tagged in:

The company now sees the commodity averaging $2.55 per gallon in 2023, $2.26 per gallon in 2024, $2.22 per gallon in 2025, and $2.20 per gallon in 2026. A Bloomberg Consensus published in the report sees the commodity coming in at $2.56 per gallon this year, $2.70 per gallon next year, $2.65 per gallon in 2025, and $2.94 per gallon in 2026.

Surging gasoline prices in the U.S. are showing signs of impact on consumption, according to one risk analyst. “We’re starting to see some signs of demand destruction, particularly for gasoline, but it’s really just off some of the highs of last year, when gasoline prices were much cheaper,” said Rachel Ziemba, founder of Ziemba Insights, a research firm. Demand destruction refers to persistent high prices or tight supplies that eventually lead to a drop in demand, in this case, for energy products such as oil or gas.

Brent prices could soar to a "stratospheric" $380 a barrel in "the most extreme scenario" of Russia slashing oil production by 5 million barrels per day(bpd) in retaliation to the price cap being considered by the Group of Seven, analysts at J.P. Morgan said in a note dated July 1. G7 economic powers agreed last week to explore imposing a ban on transporting Russian oil that has been sold above a certain price, aiming to limit Moscow's ability to fund its invasion of Ukraine, which Moscow describes as a "special operation".

Millions of customers and businesses are concerned about whether and how the current energy crisis, which resembles the oil crisis and the high inflation of the early seventies, will impact net zero plans. This concern was echoed by Phil Manock, Head of Sales and Business Development at British Gas – which works in partnership with Centrica Business Solutions, who spoke to Sumit Bose, the Founder of future Net Zero during The Big Zero Show at the Coventry Building Society Arena. Mr. Manock said: “I think the main challenge right now is rising energy costs. Only 12 to 18 months ago, a customer spending a million pounds a year for the same energy today is probably spending three million pounds a year. “Part of the situation is to help customers through that energy crisis with solutions that we can try and find through better energy purchase or looking at how we can decarbonize and reduce energy costs more differently, it’s about where they are wasting energy? “We are investing £500 million in building a 900MW portfolio of solar and battery storage assets by 2026.

Oil prices in Alaska have surged to their highest levels in a decade. But job numbers in the oil and gas industry have barely budged upward after they crashed during the COVID-19 pandemic, even as other sectors of the economy enjoy a solid rebound. Industry observers in Alaska give several reasons for the tepid job growth in the oil patch. They say it mirrors a trend in the industry nationally, a slow recovery that breaks from past practice. Companies, increasingly flush with cash, aren’t investing in oil field activity like they once did when the good times rolled. They say companies are now more likely to question big, long-term projects, as investors raise concerns about the industry’s past performance and new regulations that could result from climate change policies.

The new global order after the Russian invasion of Ukraine is set to create new winners and losers in energy as trade flows are changing. Russia is still receiving close to $1 billion in oil and gas revenues every day as Europe continues to buy Russian gas and is panicking over the possibility of Russia cutting off gas supply entirely. In the short term, Russia may have a winning hand, having hooked major European economies to its natural gas. Russia’s invasion of Ukraine has set in motion a series of events that will forever change the global energy order. In the medium- and long-term, the United States is in a very strong position to take advantage of these new dynamics . While Russia is benefitting from high oil and gas prices in the near time, the long-term outlook for its energy industry is poor.

Canadians continue to experience significant financial strain as the cost-of-living soars. Seven in ten drivers say they are worried that they won't be able to afford the price of gas this summer. Families are living paycheck to paycheck and young Canadians are struggling because this federal government chose to leave people without the direct support they desperately need to get through the summer.

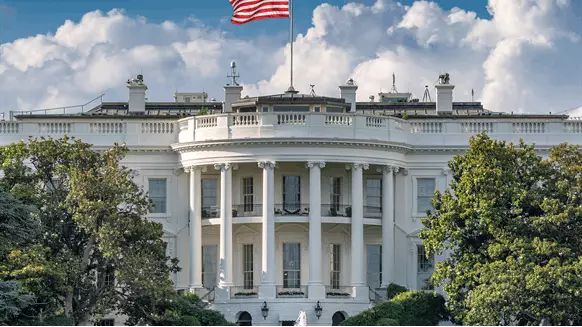

The U.S. Department of Energy (DOE) confirmed Thursday that Secretary of Energy Jennifer M. Granholm led an in-person meeting with CEOs and executives of seven major U.S. oil companies at the DOE headquarters in the morning of June 23. Granholm reminded the companies that their consumers, workers, and communities are feeling the pain at the pump because of Putin’s price hike and that at a time when Putin is using energy as a weapon, oil companies must deliver solutions to ensure secure, affordable supply, a DOE statement noted.

Indian shares were little changed on Monday, with gains in consumer stocks offset by losses in metals, while global prices of copper and crude oil declined. The NSE Nifty 50 index (.NSEI) edged up 0.05% to 15,302.8 by 0516 GMT, while the S&P BSE Sensex (.BSESN) was up 0.1% at 51,423.83. Both indexes fell over 5% last week in their biggest weekly drop in two years. Oil prices dropped to $113.04 per barrel while copper prices also fell, on fears that a recession would dent demand for metals.

The price of petrol in South Africa is up to 81c a litre to R20.35, effective from 1 December. That is what you will pay for 95-octane petrol in Gauteng. Unleaded 93 is 22c per litre cheaper inland. The various taxes bundled into the petrol price comes to R6.25 per litre. For December, that represents 31% of the pump price for inland 95. The price of petrol itself, known as the basic fuel price or BFP, is at R9.74, or 48% of the total price at the pump. The remainder is made up of a dealer margin, now at 11.52% of the total, a further wholesale margin of 2.24%, and charges related to handling and storage

The European Commission has approved Polish offshore wind support policy following a state aid review. The scheme is intended to support offshore wind farms and has a total maximum budget of €22.5bn running until 2030. The aid will be granted in the form of a two-way contract-for-difference premium, during 25 years, but only up to 100,000 full load hours per MW of installed capacity.

New renewable electricity capacity added in 2020 rose by 45%, compared with 2019, to 280GW, the fastest rate since 1999, according to a new report from the International Energy Agency (IEA). The 'Renewable Energy Market Update: Outlook for 2021 and 2022' report said that expansion rates in coming years are expected to be at a much faster pace than prior to the Covid-19 pandemic.

Conoco's average gas price from its Lower 48 operations more than doubled to $4.56/mcf from the fourth quarter. Diamondback, which operates in the heart of Texas's biggest shale field, saw average gas prices jump more than 21 times to $3.05/mcf from a year earlier. The combined company produced 1.32 Bcfg in the period, more than double Conoco's in the previous quarter, which helped offset the financial impact of lost oil production from the freeze.

BEIJING: China Petroleum & Chemical Corp, better known as Sinopec, plans a 23.8% increase in capital spending to 167.2 billion yuan in 2021 following recovery of oil prices and energy demand as the COVID-19 epidemic subsided.Sinopec expects to spend 66.8 billion yuan on upstream exploration focusing on shale gas development in southwest China

The imposition of basic customs duty (BCD) on solar cells and modules with effect from 1 April 2022 would lead to an increase in solar tariffs, reducing the overall attractiveness of solar projects to off-takers and finally end-consumers, according to India Ratings and Research (Ind-Ra).“The increase in tariffs will increase power purchase costs for solar off-takers by Rs 9 billion annually".

The tariffs for solar power could increase between 25-45 paise per unit (kWh) due to Basic Customs Duty (BCD) on imported solar cells and modules, according to a rating agency. The Ministry of New and Renewable Energy's (MNRE) announcement of the BCD implementation on imported solar cells (25 per cent) and modules (40 per cent) starting April 1 could increase the solar power tariff, it said.

The newly established government of Pakistan yesterday elevated natural gas prices by 20%. Regarding it as a tough decision, Petroleum Minister Chaudhry Mohammad Sarwar stated that the decision will enable Pakistan to bridge a 152 billion rupee deficit for the two main suppliers - Sui Northern and Sui Southern. The minister held the previous government of now-jailed Prime Minister Nawaz Sharif accountable for the huge deficit.

The OPEC meeting in Vienna yesterday ended with a decision to boost output from July after Saudi Arabia convinced Iran to cooperate. The crude prices, however, hiked by some 3%. Brent crude rose to $75.24 before slipping to around $75. WTI crude traded at $67.34. Sources have told news agency Reuters that the cartel agreed to surge production by about 1 million bpd.