fetching latest news

News tagged in:

"Consolidated PAT before Exceptional Items up by 76 per cent YoY (year-on-year) at Rs 775 Crore in March quarter vs Rs 440 Crore in Q4 FY21 (March quarter), " the company said in the statement.

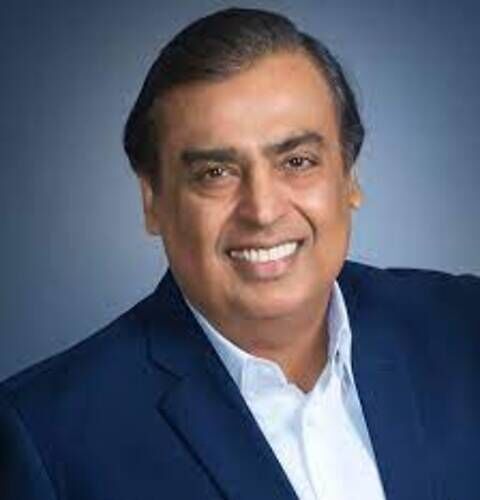

"The conglomerate, which is owned by Asia's richest man Mukesh Ambani, reported a net profit of 162.03 billion ($2.1 billion) between January and March, 22.5 percent than the same period last year."

Exxon reserves of the dense, heavy crude extracted from Western Canada’s sandy bogs dropped by 98%. In practical terms, the revision clipped Exxon’s future growth prospects until oil prices rise, costs slide or technological advances make it profitable to drill those fields.The reserves accounting doesn’t mean Exxon is closing up shop or walking away from Canada because the company can bring them back onto its ledger as crude prices rise.

ExxonMobil agreed to sell some assets in the North Sea for more than $1 billion as the company focuses on newer and larger sources of oil and gas such as Guyana, Brazil and the U.S. Permian Basin. The company will sell most of its non-operated upstream assets in the UK central and northern North Sea to NEO Energy. NEO is an oil producer backed by Norwegian private equity firm HitecVision AS.

ExxonMobil has already upped its climate plans, only three months into an activist investor’s campaign to force change inside the company. Engine No.1, is pushing the oil giant to set new goal, net-zero greenhouse gas emissions by 2050. Engine No.1 released a letter reiterating its call for Exxon to overhaul its board of directors by adding four new members who have the expertise to steer the company towards climate neutrality.

Exxon Mobil Corp signalled in a regulatory filing that higher oil and gas prices and improved chemicals margins would aid fourth-quarter results, but the gains would be overshadowed by an up to $20 billion asset write down. Exxon expects higher prices will sequentially lift its oil and gas operating results by between $200 million and $1 billion.

Oilfield services firm, Petrofac reported revenues of $2.1bn in the first half, 25.5% below the same period last year. The earnings report reflects project delays caused by COVID-19 and lower oil & gas prices. The underlying profits after tax fell 86.4% to $21m, despite Petrofac's significant cost savings efforts during the year. The total order book shrunk from $7.4bn at the start of the year to $6.2bn towards the end of first half.

Occidental Petroleum Corp on Monday posted a $8.35 billion second-quarter. Its net loss was $8.35 billion, or $9.12 per share, in the quarter, compared with earnings of $635 million, or 84 cents per share, a year earlier. Its oil and gas production will fall 13% this quarter over last, and another 5% in the fourth quarter, to 1.16 million barrels of oil and gas per day.

Adani Gas Ltd, on Wednesday reported a 42 per cent drop in June quarter net profit as sales volumes got impacted because of the coronavirus lockdown. Net profit of Rs 46 crore in April-June compared with Rs 79 crore net profit a year back. Revenue fell 57 per cent to Rs 207 crore while EBITDA was down 41 per cent at Rs 86 crore.

Marathon Oil Corp posted a smaller-than-expected loss on Wednesday as it reined in costs to cushion the impact from the COVID-19 pandemic. It cut its cost and expenses by 17.2% to $975 million as the average realized price for its U.S. crude oil and condensate fell 63.4% to $21.65 per barrel. Marathon’s total net production for the quarter fell to 390,000 boepd from 435,000 boepd a year ago.

Mexico’s Pemex reduced losses during the second quarter even as crude prices fell during the coronavirus pandemic. The 44.3 billion peso net loss during the April-June period was over 16% lower than the nearly 53 billion pesos Pemex lost in the same period last year. During the quarter, Pemex’s financial debt rose nearly $2.4 billion to $107.2 billion, one of the largest of any oil company worldwide.

Oil & Gas UK has estimated a significant drop in production revenue from the UK Continental Shelf. It has also predicted that the UK oil and gas industry might lose as many as 30,000 jobs over the next 12–18 months. The industry trade body commented, "The outlook is bleak compared to the picture of steady growth seen only two months ago, before the grip of the pandemic became clear”.

India's Oil and Natural Gas Corporation has reported a 37% decline in its net profit in the second quarter. Due to lower production and price realisation, the companies profit dropped down and was at Rs 5,487 crore. The company's revenue from operations has also dropped by 0.50% to Rs 101,554 crore. The natural gas production of ONGC has also suffered in this quarter and declined 17.4% to $60.33 per barrel.

BP has reported a sharp decline in profit in Q3. Its revenue was hurt the most by a fall in oil prices. Although strong refining operations have helped BP perform better than expected by the market. The firm has taken one-off charge of $2.6 billion linked to large asset sales. "BP delivered strong operating cash flow and underlying earnings in a quarter that saw significant hurricane impacts", informed it's CEO.

The third-largest fuel retailer of India, HPCL has reported a substantial drop in the first quarter's profit. The company has informed 53% slump in net profit, at Rs 811 crore due to lower refining margins. "During April- June 2018, loss of Rs 537.73 crores on account of foreign currency transactions and translations was Included in Other Expenses," said HPCL. The crude throughput of the company reduced to 3.92 Million Tonne.

Diamond Offshore has reported losses in the first half of 2019. The losses have more than doubled and pre-tax losses were registered to be £179 million. The total revenue of the company dropped down to £370m. Also, a backlog of £1.6bn was reported by the firm. However, Diamond has recently secured a new contract for Ocean GreatWhite.

India's downstream giant, IOCL has reported a 50% decline in profit for the first quarter which ended in June. The consolidated net profit of the company went down to Rs 3,624 crore due to lower refinery margins and product sales. Revenue from operations went up a little to 0.44% and were at Rs 1,52,496 crore. Also, the expenses of the company increased in this quarter to Rs 1,47,953 crore.

Canadian oil and gas producer Encana Corp has reported profit in its quarterly report. The net income of the company rose to $336 million in the second quarter compared to the loss of $151 million in the corresponding quarter last year. Encana's profit increased with the boost in production this year. Total rise in production was about 11% to 591,800 barrels of oil equivalent per day (boe/d) in the quarter.