fetching latest news

News tagged in:

OPEC+ pumps approximately 40% of the world’s crude and policy decisions can have a significant impact on prices.

Analysts expected to see a dip in net profit this quarter compared to the previous year, as inflation and rising interest rates pressure global demand and stoke fears of a recession.

The China-brokered Saudi-Iran rapprochement is a major diplomatic breakthrough after years of mutual animosity, suspected attacks and espionage between the two countries. It represents Beijing’s first foray into Middle East mediation, an area that for the past few decades was largely occupied by Washington.

China's finance and investment spending in Belt and Road countries fell slightly in the first half compared to a year earlier, with no new coal projects and investments in Russia, Egypt and Sri Lanka falling to zero, new research showed. Saudi Arabia was the biggest recipient of Chinese investments over the period, with about $5.5 billion, According to the Shanghai-based Green Finance and Development Center (GFDC) in research published on Sunday.

President Joe Biden told Arab leaders the United States would remain an active partner in the Middle East, but he failed to secure commitments to a regional security axis that would include Israel or an immediate oil output rise.“The United States is invested in building a positive future of the region, in partnership with all of you — and the United States is not going anywhere,” Mr Biden said on Saturday (Sunday AEST), according to a transcript of his speech.

A refinery in Saudi Arabia's capital, Riyadh, was attacked by a drone on Thursday morning but petroleum supplies were not affected, Saudi state news agency SPA reported early on Friday.

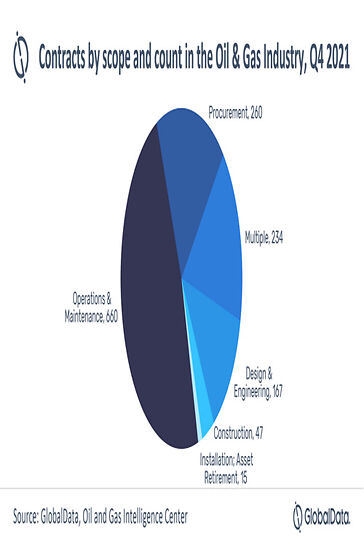

In Q4 of 2021, the oil and gas industry has seen an increase of 77% in overall contract value however, there has been a decrease of 14% in the number of contracts says GlobalData, a leading data and analytics company.

Oil demand suffered a severe blow last year when the initially ignored coronavirus in China spread around the world and started prompting lockdowns. Then the wave receded, and oil demand began to rebound, much faster than most expected. Despite the green transition push, demand will continue to recover into next year, too, and those after it. Many forecasters, including BP, in 2020 argued that peak oil was already past us and what we had to look forward to was a more renewable energy mix. And then Covid-19 case numbers in key markets began to decline, and oil demand began to rise. Since then, demand has rebounded so strongly that it has led forecasts to start warning of the possibility of a shortage. Saudi Arabia recently warned that underinvestment in new oil and gas production would lead to higher prices and supply crunches.

OPEC+, a 23-nation group led by Saudi Arabia and Russia, decided on Dec. 2 to raise daily oil output by 400,000 barrels in January. But it kept the meeting open and said it would be able to reconvene at short notice to change course. "I call my friends every day, we chat and share notes," Prince Abdulaziz bin Salman said in Riyadh, referring to fellow OPEC+ ministers. "So the meeting is truly not suspended. It continues to be in session." That strategy has helped bolster crude prices by making traders warier of taking short positions, according to analysts.

Saudi Aramco has agreed a $15.5 billion lease-and-leaseback deal for its gas pipeline network with a group of companies led by BlackRock Real Assets and state-backed Hassana Investment Company. As part of the deal, the world's largest exporting company's newly-formed unit, Aramco Gas Pipelines Company, will lease usage rights in the state energy firm's gas pipelines network and lease them back to Aramco for a 20-year period, the company said in a statement.

Oil futures climbed on Monday, with news that the omicron variant may not lead to severe cases of COVID-19 and Saudi Arabia's move to lift crude prices for some buyers providing support. The Saudi move "portrays confidence in the markets but it doesn't alter the uncertain outlook in any way," said Craig Erlam, senior market analyst at Oanda. The most bullish thing for oil prices is that omicron is "reportedly less severe and if more good news follows, we can all relax a little and the downside risks to the economy will abate." January West Texas Intermediate crude CLF22, +1.02% rose $3.23, or 4.9%, to settle at $69.49 a barrel on the New York Mercantile Exchange.

SINGAPORE, Dec 6 (Reuters) - Oil prices rose by more than $1 a barrel on Monday after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.S.-Iran talks on reviving a nuclear deal appeared to hit an impasse. Brent crude futures for February gained $1.69, or 2.4%, to $71.57 a barrel by 0033 GMT while U.S. West Texas Intermediate crude for January were at $67.92 a barrel, up $1.66, or 2.5%.

The US-led proposal to release strategic oil reserves in a bid to lower oil prices, which was backed by South Korea, China, Japan, India, and the United Kingdom, was met with opposition from major oil producers such as Saudi Arabia and Russia, suggesting a move to phase down oil production. Concerns about a probable oil price increase are mounting as global oil prices continue to rise despite plans to release strategic oil reserves and major oil producers launch a counterattack. According to the Wall Street Journal, Saudi Arabia and Russia, the world's two largest oil producers, are considering a shift in oil policy by reducing production in reaction to the US-led proposal to release strategic oil reserves in an effort to lower oil prices. OPEC, led by Saudi Arabia, and OPEC+, made up of OPEC members and non-oil producing countries, were also mentioned in the publication.

As we enter the final quarter of 2021, it is a good time to look back on how the region’s economies have performed so far compared with our expectations at the start of the year and also to recalibrate our outlook for next year. The UAE has yet to release official gross domestic product statistics for the first and second quarters of this year, but the PMI survey data suggests that the non-oil sectors have continued their gradual recovery following last year’s Covid-related contraction. Companies have generally reported increased activity on a monthly basis and domestic demand appears to be strengthening. Although global travel restrictions have continued to weigh down the tourism sector, the outlook for the fourth quarter is brighter here as well.

Saudi Arabia is on a tight deadline. The kingdom has set itself some of the most ambitious economic and social targets in the region, with an aim to revamp its economy completely. Underpinning this drive for change is its youth population, now better equipped than ever to contribute productively. Not only does the kingdom want to retain its place as the largest economy in the Middle-east, but do much better than that, to ensure it becomes a magnet for non-oil sectors worldwide. At an average age of just 32, Saudi Arabia has a strong cohort of the young, that has acquired quality qualifications in the recent past, thanks to high investments in building up education and health infrastructure.

DNV, the independent energy expert and assurance provider, has acted as technical consultant to Saudi Power Procurement Company (SPPC) during the development of the 1.5 GW Sudair Solar PV project. DNV supported SPPC for over two years with a scope of work which included preparation of project protocol documents, setting the technical conditions of the project, such as project grid interconnection requirements, technical aspects of the PPA and the transmission connection agreement.

Saudi Arabia is celebrating one of the biggest foreign-investment windfalls in its history after netting more than $12 billion by selling off a stake in the oil pipelines that traverse the desert kingdom.But the country may also be facing an uncomfortable reality as a result. As carefully cultivated relationships with firms such as BlackRock Inc. and SoftBank Group Corp. have yet to draw in the desired investment, it’s turning to the jewels of its energy industry to attract new money.

Saudi Arabian energy company ACWA Power has announced the opening of a utility-scale solar renewable energy project in the country. The 300MW Sakaka PV independent power producer (IPP), which was built with an investment of SAR1.2bn ($319m), was inaugurated by Crown Prince Mohammed bin Salman. Salman said: “The private sector plays a fundamental role in the development of renewable energy projects in Saudi Arabia.