fetching latest news

News tagged in:

Asia needs to reach net zero before the world can do so, Tengku Muhammad Taufik said when asked about his views on the world’s net-zero targets. Encompassing fossil fuels as part of the energy base, at least for the first half of the century, is needed if the world wants to move itself away from energy shocks, the Petronas CEO added.

A protest movement opposing plans for a Shell-backed regasification terminal in the Philippines has come to London to have its voice heard.

OMV has decided to explore the possibilities of selling the exploration and production (E&P) assets in the Asia-Pacific region. The oil and gas producer is considering initiating the related sales process for the potential divestment of its 50% stake in the issued share capital of SapuraOMV Upstream Sdn. Bhd. in Malaysia.

A total of 95.28% of the votes cast at the 16 virtual extraordinary general meeting were to approve the S$4.5 billion (US$3.37 billion) deal. The two shipyards have been working on a merger since July last year and the idea for a union of the two Singapore-listed companies has been discussed in industry circles for decades.

China's finance and investment spending in Belt and Road countries fell slightly in the first half compared to a year earlier, with no new coal projects and investments in Russia, Egypt and Sri Lanka falling to zero, new research showed. Saudi Arabia was the biggest recipient of Chinese investments over the period, with about $5.5 billion, According to the Shanghai-based Green Finance and Development Center (GFDC) in research published on Sunday.

China's finance and investment spending in Belt and Road countries fell slightly in the first half compared to a year earlier, with no new coal projects and investments in Russia, Egypt and Sri Lanka falling to zero, new research showed. Saudi Arabia was the biggest recipient of Chinese investments over the period, with about $5.5 billion, According to the Shanghai-based Green Finance and Development Center (GFDC) in research published on Sunday.

With thermal coal and liquefied natural gas (LNG) prices holding close to record highs in Asia, it would be logical to expect demand destruction, especially in developing nations said to be price sensitive. But it isn't happening yet.India, the world's second-biggest coal importer, behind China, saw record arrivals in June of thermal coal, used mainly to generate electricity, according to data compiled by commodity analysts Kpler.

With thermal coal and liquefied natural gas (LNG) prices holding close to record highs in Asia, it would be logical to expect demand destruction, especially in developing nations said to be price sensitive. But it isn't happening yet.India, the world's second-biggest coal importer, behind China, saw record arrivals in June of thermal coal, used mainly to generate electricity, according to data compiled by commodity analysts Kpler.

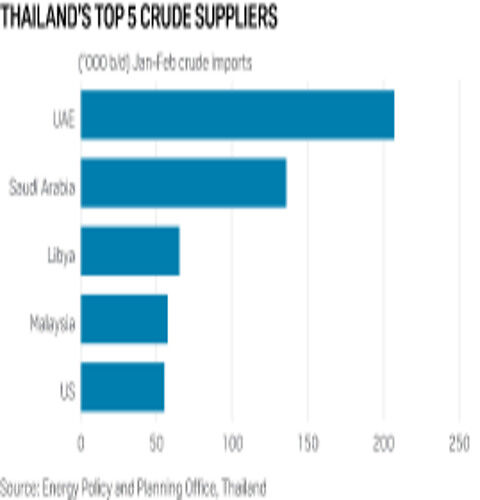

Libya's oil production woes may not dramatically alter Asia's crude buying plans due to the region's relatively low dependence on those supplies, but refiners are bracing for some price impact and supply squeeze as traditional customers of the North African OPEC producer scramble for cargoes from elsewhere.

Western countries have announced measures to ban or reduce the use of Russian oil, gas and coal due to Moscow's military operation in Ukraine.

Shell has become the first supplier of sustainable aviation fuel (SAF) in Singapore, and plans to start blending the fuel at its plant in the aviation hub.

SINGAPORE — Asia-Pacific markets tumbled on Friday, tracking declines on Wall Street overnight. Meanwhile, oil prices slipped from their 2014 highs earlier in the week, falling about 2%. Japan’s Nikkei 225 fell 2%, while the Topix was down 1.54%. Auto and tech stocks fell across the board, but pared some losses. Toyota was down more than 3%, Mazda dropped nearly 5% and Mitsubishi fell more than 4%. In tech stocks, Sony was down more than 2%, and Softbank declined 2%. Japan’s inflation data released on Friday showed that core consumer prices rose 0.5% in December compared to a year earlier, as fuel and raw material costs increased, according to Reuters. The increase was for a second month straight at the fastest pace in nearly two years, Reuters said.

Asia's petrochemical makers are shifting, or considering to use propane as alternate steam cracker feedstock amid the deepening discount of propane to naphtha, as LPG is pressured by ample supply and a lull in Chinese and Indian demand, traders said Jan. 21. South Korean crackers have started seeking propane, traders said, even when the discount of February FEI propane swap to the Mean of Platts Japan naphtha was around $26.25-$26.50/mt over Jan. 17-18, before widening to $36/mt Jan. 20. This is the deepest discount since June 8, 2021, at $41.50/mt, Platts data showed. In contrast, the difference between FEI propane and MOPJ naphtha was at a premium of $185/mt on Oct. 4 last year.

Investing.com – Oil was up Tuesday morning in Asia, after rebounding almost 5% the day before. Concerns about the omicron COVID-19 variant’s impact on fuel demand receded, while talks to revive an Iranian nuclear deal hit a snag. Brent oil futures were up 0.36% to $73.34 by 10:22 PM ET (3:22 AM GMT) and WTI futures gained 0.63% to $69.93. Ntsakisi Maluleke, a public health specialist in South Africa’s Gauteng province said over the weekend that patients with the new omicron COVID-19 variant had only shown mild symptoms. National Institute of Allergy and Infectious Diseases director Anthony Fauci also said, "it does not look like there's a great degree of severity" so far.

Sweet crude grades from the U.S. Gulf Coast have seen increased interest from Asian buyers in recent weeks, as many refiners in the world’s largest oil-importing region are purchasing more of the sweeter crude varieties, energy analytics firm Vortexa says. Asian refiners are looking for more crude of the sweeter variety as high energy costs are making sour crude processing more expensive. The high cost of hydrogen, which is used to remove the sulfur from the sour grades in diesel hydrocrackers, has risen in recent months amid the natural gas crunch in Europe and Asia.

Australia is expected to witness the commencement of 118 oil and gas projects’ operations across value chain during the period 2021-2025, accounting for 6% of the total project starts in the Asia-Pacific (APAC) region. ‘Asia Pacific Oil and Gas Projects Outlook to 2025 - Development Stage, Capacity, Capex and Contractor Details of All New Build and Expansion Projects’, reveals that of the 118 projects during the outlook period, upstream projects would be 53, midstream projects would be the highest with 56 projects and petrochemicals at nine.

Saudi Arabian state oil giant Aramco is betting on an Asian-led rebound in energy demand this year after it reported a steep slide in net profit for 2020 on Sunday and scaled back its spending plans.The world’s largest oil exporter said net profit fell 44.4% to 183.76 billion riyals ($49 billion) for the year ended Dec. 31, from 330.69 billion riyals a year earlier.

Saudi Arabia raised pricing for its crude for shipment to Asia and the U.S. next month after OPEC+ extended oil supply constraints, pointing to a tightening physical market. State oil producer Saudi Aramco increased pricing for Arab Light crude for Asia, its largest regional market, by 40 cents a barrel to $1.40 more than the benchmark. Aramco raised all other pricing to Asia, except for its Heavy crude which remained unchanged.