fetching latest news

News tagged in:

Oil dropped as broader risk-off sentiment overshadowed news of China’s gradual rollout of stimulus measures to aid its economy.

Kazakhstan’s ability to diversify its seaborne crude oil export routes away from Russian territory is critical to the country’s economy, the developer of an alternative port told CNBC. Semurg Invest has been working to develop the Kuryk port on the eastern coast of the Caspian Sea — a project that includes a bulk cargo terminal, designed for the transshipment of oil, bulk oil cargo and liquefied petroleum gas.

LYTT, a provider of real-time, sensor analytics platform and applications suite, and Amazon Web Services (AWS), the world’s most comprehensive and broadly adopted cloud platform, have collaborated to enrich and scale LYTT’s sensor fusion insights platform using AWS’ industry-leading cloud infrastructure.

Oil prices rose on Tuesday for a second day on increasing concerns about tightening European supply after Russia, a key oil and natural gas supplier to the region, cut gas supply through a major pipeline. Brent crude futures for September settlement rose $1.66, or 1.6%, to $106.81 a barrel by 0618 GMT, extending a 1.9% gain in the previous day. U.S. West Texas Intermediate (WTI) crude futures for September delivery increased $1.47, or 1.5%, to $98.17 a barrel, having gained 2.1% on Monday. Russia tightened its gas squeeze on Europe on Monday as Gazprom (GAZP.MM) said supplies through the Nord Stream 1 pipeline to Germany would drop to just 20% of capacity. read more Russia's cut in supplies will leave countries unable to meet its goals to refill natural gas storage ahead of the winter demand period. Germany, Europe's biggest economy, faces potentially rationing gas to industry to keep its citizens warm during the winter months.

Investors purchased small volumes of petroleum last week, after exceptionally heavy sales the week before, squaring up short positions after an unusually sudden and steep pull back in prices on recession fears. Hedge funds and other money managers purchased the equivalent of 8 million barrels in the six most important petroleum futures and options contracts in the week to July 12. That came after cumulative sales of 201 million barrels over the previous four weeks, culminating in sales of 110 million in the week to July 5, according to ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

Oil and gas production in Texas rose month on month, according to the latest preliminary figures from the Texas Railroad Commission (RRC). The preliminary reported total volume of crude oil in Texas in March was 110.9 million barrels, equating to 3.57 million barrels per day, the RRC highlighted. The preliminary reported total volume of natural gas in March was 829.45 billion cubic feet, equating to 26.75 billion cubic feet per day, the RRC revealed.

Sri Lanka’s fuel stocks will last for about five more days, its power and energy minister said on Thursday. Chronic fuel shortages have worsened this week with long lines at some gas stations countrywide. The stocks cover fuel for vehicles, some industries and essential services. Sri Lanka is unable to make $725 million in overdue payments to suppliers and also struggling to open letters of credit for future shipments, power and energy minister Kanchana Wijesekera said. “We are struggling to get fuel supplies due to our forex issues and the government is working to manage existing stocks of diesel and petrol until June 21. Stocks could run out faster if we do not cut back on non-essential travel and stop hoarding fuel. ” “We are expecting a petrol shipment within the next three days and another two shipments in the next eight days,”

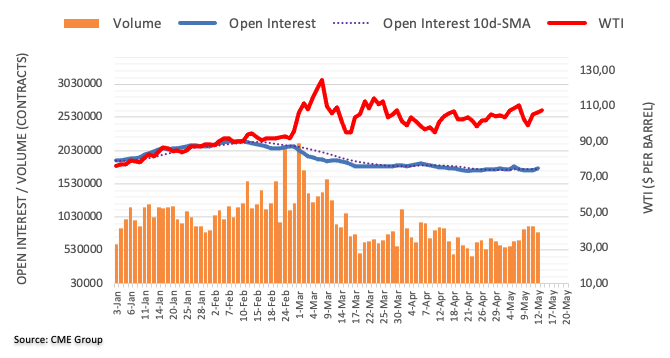

According to preliminary readings from CME Group for crude oil futures markets, traders added around 18.3K contracts to their open interest positions on Thursday. Volume, instead, shrank for the second session in a row, this time by nearly 96K contracts.

The U.S. government, under pressure to lower gas prices, announced on April 15 that it will resume the sale of leases for oil and gas drilling on federal lands while imposing new conditions, including the first hike in royalties in more than 100 years.

The basket of crude oil that India buys averaged USD 100.71 per barrel that day as compared to USD 82 in early November 2021 when state-owned fuel retailers hit the pause button on daily price revision.

Shanghai launches two-stage lockdown as COVID-19 cases surge OPEC+ to meet on Thursday Russia-Ukraine peace talks could start on Tuesday - Kremlin More emergency releases of U.S. reserves expected

Crude oil imports last month rose 7.1% versus November to 19.65 million tonnes, data on the website of the Petroleum Planning and Analysis Cell (PPAC) showed on Monday.

Crude oil futures were trading lower and the natural gas futures were trading higher on the Multi Commodity Exchange (MCX) on Thursday morning. January crude oil futures were trading at ₹5,726 in the initial hour of Thursday morning trade as against the previous close of ₹5,828, down by 1.75 per cent. March Brent oil futures were at $79.69, down by 1.37 per cent and February crude oil futures on WTI were trading at $76.80, down by 1.35 per cent.

Oil prices rose Monday as the market kicked off 2022 on a positive note, although concerns over demand waning due to rapidly spreading Covid-19 pandemic limited gains. Brent crude added 67 cents, or 0.86 per cent, to $78.45 a barrel, as of 5.32 am. US West Texas Intermediate crude futures gained 77 cents, or 1.02 per cent, to $75.98 a barrel. Last year, oil prices rose around 50 per cent, spurred by the global economic recovery from the Covid-19 pandemic slump and producer restraint, even as infections reached record highs worldwide.

Petrol price in India crosses Rs 100 mark in early 2021 as the prices of both crude and products saw a big spike in the global market. In Sri Ganganagar town in Rajasthan, normal petrol price shot up over Rs 100 per litre to stand at Rs 100.49 a litre on the 2nd week of February 2021. The petrol and diesel prices have increased 22 times in 2021 with the two auto fuels increasing by Rs 6.17 and Rs 6.40 per litre respectively so far this year.

Nigeria’s crude oil revenue looks set to decline as Royal Dutch Shell Plc halted crude shipments from the country’s Forcados export terminal amid falling oil production. Bloomberg reported on Wednesday that Shell Petroleum Development Company of Nigeria Limited issued a notice of force majeure on Forcados shipments, effective from midday on Tuesday, and planned to issue a revised offtake programme in due course. More than 200,000 barrels per day of Nigerian crude normally pass through the terminal, according to the report. The shutdown comes just a month after Shell said it was restoring flows from the nearby Bonny facility. Force majeure is a clause that allows companies to skip contractual obligations following issues outside of their control. The stoppage occurred during replacement of one of the two single point moorings at Forcados, with the positioning of a jack-up barge preventing tanker access, export operations and resumption of full production into the terminal, Nigerian National Petroleum Company Limited was quoted as saying in a notice. The presence of the jack-up offshore support vessel Seacor Strength at the Forcados moorings was confirmed by ship tracking data monitored by Bloomberg. According to the report, neither NNPC nor Shell gave an indication of the likely duration of the stoppage.

Aiteo Eastern Exploration and Production Company says it has halted oil spillage from the wellhead in Nembe Local Government Area of Bayelsa State. The wellhead blew up on November 5 in the Santa Barbara South field in Nembe, polluting water, gas and oil in the area. The Governor of Bayelsa State, Douye Diri, had expressed displeasure on the high volume of crude oil being spilt continuously to many more communities and its effect on the economic life of residents but the oil company said it was working to address the problem.

Rising oil prices are here to stay according to JPMorgan, with the bank estimating that Brent prices could hit $US150 ($AU210)/bl in 2023 as the OPEC+ cartel control supply and defend higher prices. That means the Biden administrations release of strategic petroleum reserves will have little impact on the underlying price of oil, as was made clear in the initial price reaction in oil last week after the government flooded the market with 50 million barrels.