fetching latest news

News tagged in:

Energy giant Royal Dutch Shell sold its oil and gas business in the Permian Basin, the country’s largest oilfield, to ConocoPhillips for $9.5 billion cash on Monday. The deal is a major move for Shell, which produces more than 175,000 barrels of oil per day in the Permian Basin, as it faces pressure to reduce its oil and gas production and produce more clean energy in response to concerns from investors and the public about climate change. For Houston-based ConocoPhillips, Monday’s announcement furthers the company’s investment in the Permian Basin. Last year, the company bought large oil driller Concho Resources for $9.7 billion.

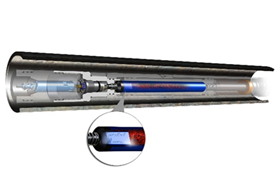

Titan Division of Hunting Energy Services, today introduced its new PowerSet Recon addressable power charge. Enabled by Hunting’s ControlFire Recon technology, PowerSet Recon is industry’s only fully addressable power charge, which can be interrogated downhole with ControlFire software and at the surface with Hunting’s VeriFire panel. Complete with a built-in initiation device that eliminates the need for plug switches and igniters, PowerSet Recon is available in sizes #10F (fast-burning) and #20, and is compatible with Hunting’s T-Set setting tools.

Diamond Offshore Drilling, which recently went bankrupt, has slapped a lawsuit against Beach Energy Ltd for abruptly ending a drilling contract worth $65 million. Beach Energy ended the agreement, citing that Diamond Offshore couldn't achieve a “contractual milestone to deliver the rig”. The lawsuit filed in Houston asks the court to render the termination notice invalid, on the grounds that the delay was “largely of Beach’s own making”.

One of the industry's most prestigious conferences, CERAWeek has been cancelled due to coronavirus concerns. The event was scheduled for this month in Houston. Scrapping this conference will reduce a chance of the industry officials "to discuss how to deal with declining demand caused by the virus epidemic". During the course of this development, IHS Market highlighted the measures taken by the companies to protect the workers.

Houston bases Apache Corp.’s Altus Midstream Co. has announced the opening of its new Permian Basin processing plant. This plant will treat its production of natural gas and natural gas liquids. Apache’s gas output is expected to experience a rise with this plant. Further, this plant would help in processing purer streams of natural gas in large volumes.

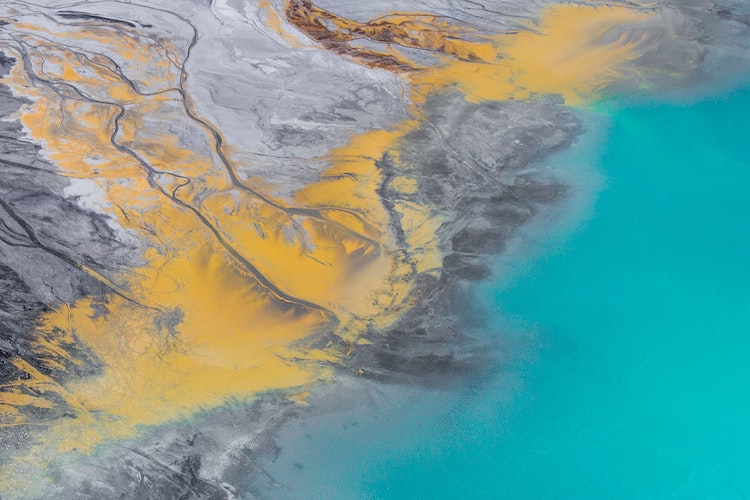

Traffic resumed at the Houston Ship Channel amidst continuous cleanup efforts to cover up the aftermath of a spill in the region. A collision in the channel between a 755-foot oil tanker and a tug pushing two barges on Friday spilled thousands of barrels of gasoline blending product into the channel. US Coast Guard informed that the collision capsized one barge, impaired the other and triggered the leak.

The energy major, ConocoPhillips has reported an increase in profits with net income surging to more than $1.8 billion. Its revenue increased to more than $10 billion in the first quarter of this fiscal year. Chief Executive Ryan Lance commented, "We continue to execute and deliver on a plan that’s resilient to lower prices while offering investors upside to higher prices.”

Mitsui’s Intercontinental Terminals Co (ITC) has been alleged with five charges by the Harris County district over the toxic chemical spill in Houston ship channel. The ITC facility in Houston was caught in a fire last month, after which a containment wall rupture leaked toxic chemicals into the Houston ship channel. A statement from the District Attorney read that the water pollution scaled to “criminal levels” during the leak.

Houston based Apache Corp. has informed about its natural gas production cut in the Permian Basin. This step has been taken for an extended period of time because of the sharp pricing discounts led by pipeline shortages in the region. Apache will reduce its production by 250 million cubic feet per day. Chief Executive of Apache said, "This is the proper approach from both an environmental and economic perspective".

Crestwood Niobrara has acquired 50% interests in Jackalope Gas Gathering Services from Williams. The acquisition is worth approximately $485 million. Crestwood went ahead to acquire William's interest as a part of its plan to expand its operations in the core growth basins. "We would like to thank Williams for what has been a very strong partnership over the last several years ", said Crestwood's CEO.

US oil major, ConocoPhillips yesterday announced a contribution of $1 million to the University of Houston’s College of Natural Sciences and Mathematics (NSM). ConocoPhillips’ aid aims at fulfilling the rising demand for data science education. The contribution will be used to fund new faculty positions in the computer science and mathematics departments in the University, including the fellowships for graduate students with strong data science skills.

The private equity firm of Houston, Quantum Energy Partners and its affiliates Post Oak Energy Capital, Concho Resources, WPX Energy and others have informed that they want to sell all of the assets of Oryx Southern Delaware Holdings LLC and Oryx Delaware Holdings LLC. The company and its affiliates have entered into an agreement to sell all the assets of Oryx to Stonepeak Infrastructure Partners for $3.6 billion.

With emergency workers siphoning leaked fuel from the United States’ busiest oil port, ship traffic remained at halt along the key stretch of Houston Ship Channel yesterday. A containment barrier at Mitsui & Co Inc’s Texas ITC breached on Friday spilling fuel. The Houston Ship Channel covers nine US oil refineries that process 2.3 million barrels of oil per day (bpd).

Texas-based Carrizo Oil and Gas Inc. has revealed its fourth quarter results. The company has reported the total production of 68,328 boed in this quarter which is 9% more than the corresponding quarter of the last year. Also, 26% increase from the corresponding last year's quarter has been reported in the proved reserves of the company.

Houston-based start-up Belmont Technology has received an investment of £3.8 million from oil supermajor, BP Plc. Belmont has developed a cloud-based geoscience platform using AI, which links geology, geophysics, reservoir and project information. The platform will enabled BP to gain a clearer understanding of its subsurface assets. Belmont’s technology aims at a 90% time-reduction in data collection, interpretation and simulation.

Houston-based Clock Spring has informed about a new technology licensing and distribution agreement for the Pipeotech AS DeltaV-Seal technology. The licensed metal-to-metal gasket technology will improve operations in refineries and petrochemical plants, apart from terminals and on upstream gathering lines. Clock Spring’s gasket employs DeltaV-Seal technology under license from Pipeotech AS.

Houston-based Fairfield Geotechnologies has farmed out its Seismic Technologies business. The firm informed today that it entered into an agreement with Norway-based Magseis ASA. Fairfield’s Seismic Technologies business comprises of data acquisition, nodal and system sale & rental activities. Magseis will also get ownership of all shares in Fairfield's wholly-owned, WGP Group.

Houston’s Nine Energy Service acquired downhole technology provider company, Magnum Oil Tools International. With this acquisition, Nine Energy becomes one of the premier providers of completion focused technology. Magnum has a large scale of proprietary downhole completion products like dissolvable and composite frac plugs, and other patented consumables. Nine’s President and CEO commented, “We could not be more thrilled to partner with Magnum.”